Dear Friend,

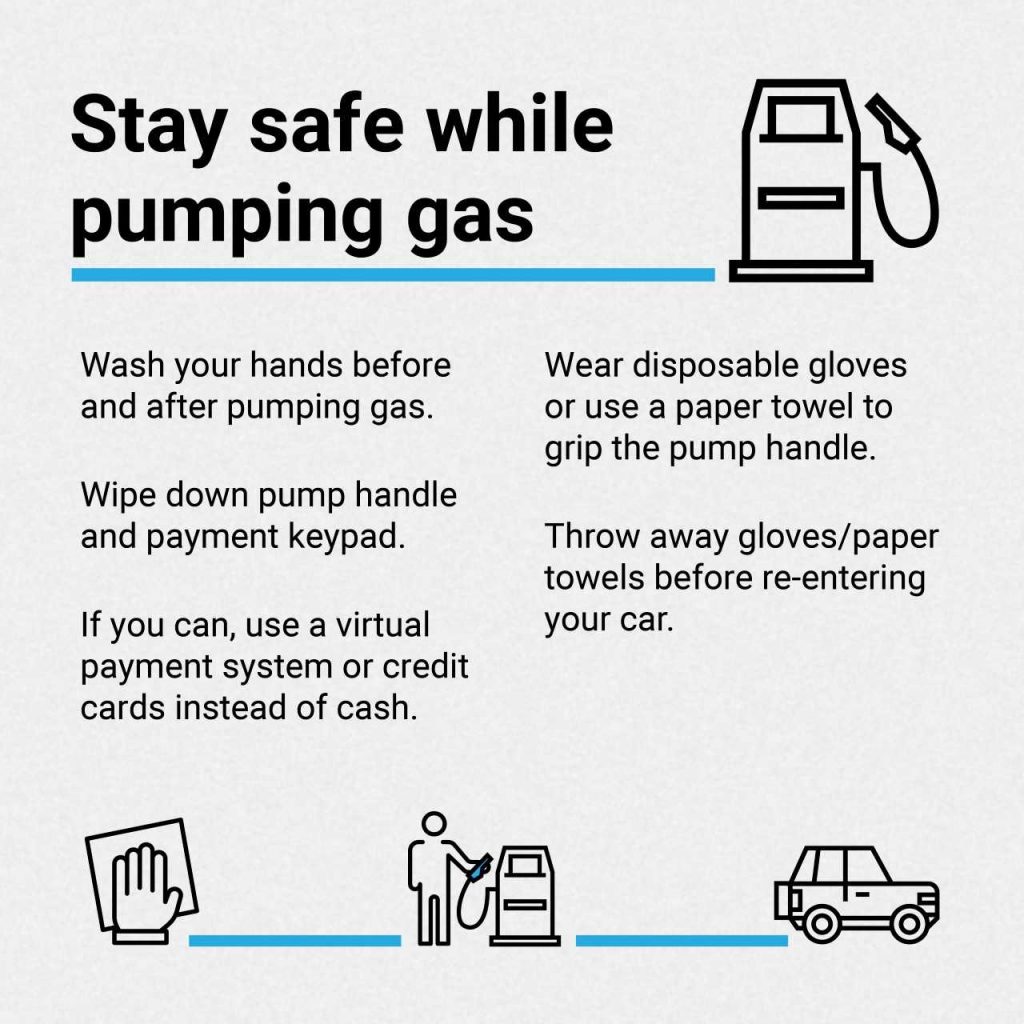

Saturday afternoon will bring the one-week mark of a ‘stay-at-home’ order implemented by Governor Pritzker. As we move about to get the essential things we need like groceries and exercise, please keep in mind some helpful tips:

Listed below are several topics of interest relating directly to the COVID-19 outbreak and its fallout. As we work to get through this difficult time, please keep in mind that we can all take steps in our own lives to limit the spread of the virus and keep ourselves and others safe.

My offices are currently closed to foot traffic, but we are taking constituent requests via phone 618-440-5090 or email [email protected]

Federal and State Income Tax Filing Deadline Extended until July 15, 2020

Last week the federal government announced that it was extending the income tax filing deadline to July 15. I joined several of my colleagues in the House in calling on Governor Pritzker to move Illinois’ filing deadline to match the new federal deadline. Thankfully, this week the governor announced that Illinois’ income tax filing deadline will be moved to July 15, 2020.

For more information please visit the Illinois Department of Revenue’s website at:

https://www2.illinois.gov/rev/research/publications/bulletins/Documents/2020/FY2020-24.pdf

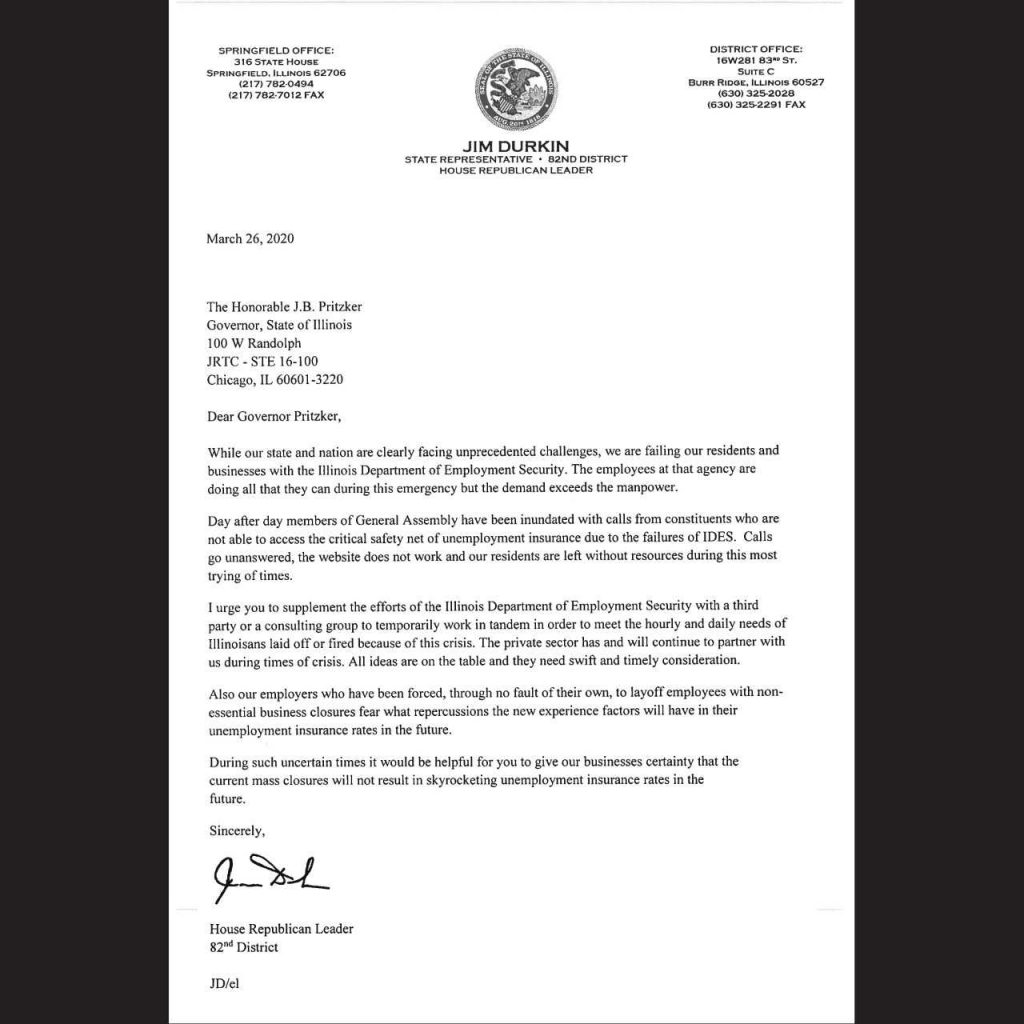

Addressing Problems with Filing for Unemployment

The past two weeks have seen record layoffs and record numbers of people applying for unemployment insurance. Schools are closed.

The State of Illinois has so far struggled to meet with website and phone call demands. There has simply been too much volume for the current employees to handle.

To that end, House Republican Leader Jim Durkin sent a letter to Governor Pritzker asking that he take whatever steps necessary to fix the website and phone call overload issues. I understand that the folks at the Department of Employment Security are doing the best they can with what they have. We are simply asking the Governor to explore using a 3rd party vendor to enhance IDES’ ability to handle the new massive caseload they are experiencing.

Help for the Unemployed

Unemployment benefits may be available to some individuals whose unemployment is attributable to COVID-19. Illinois residents who are temporarily out of work because their employer has closed due to the coronavirus or parents who leave work to care for their children because of school closures can qualify for Unemployment Insurance (UI) if they meet all the other basic requirements.

- Illinois Department of Unemployment Security (IDES)

- Apply for Unemployment Benefits

- IDES COVID-19 UI Fact Sheet

- Help for those suffering job disruption because of COVID-19

Job Search

Many businesses are hiring full and part-time employees during the COVID-19 outbreak. These sites are maintaining job opening lists and other resources job seekers may find helpful:

State of Illinois Provides Financial Assistance Available for Small Businesses

BENTON – State Rep. Dave Severin (R-Benton) is sharing information for small businesses in southern Illinois being financially impacted by the coronavirus outbreak.

The State of Illinois now offers three new programs to help Small Businesses are being facilitated through the Department of Commerce of Commerce and Economic Opportunity (DCEO).

The State of Illinois is doing what it can to aid small businesses during this stressful and unprecedented time in our history. I want to encourage small business owners to look into all available resources and to reach out to my office for assistance with any of these programs. Applications begin to open up this week so quick action is necessary.

Hospitality Emergency Grant Program – DEADLINE IS APRIL 1

To help hospitality businesses make ends meet in the midst of the COVID-19 pandemic, DCEO is launching the Hospitality Emergency Grant Program with $14 million drawn from funds originally budgeted for job training, tourism promotion, and other purposes. Grant funds are available to support working capital like payroll and rent, as well as job training, retraining, and technology to support shifts in operations, like increased pick-up and delivery. Bars and restaurants that generated between $500K and $1M in revenue in 2019 are eligible for up to $25,000, and bars and restaurants that generated less than $500K in revenue in 2019 are eligible for up to $10,000. Hotels that generated less than $8M in revenue in 2019 are eligible for up to $50,000.

Who is eligible?

Bars and restaurants with a valid license to serve food or liquor and who generated revenues of less than $1 million in 2019. Hotels with a valid license (hotels, motels other lodging establishments) and who generated revenues of less than $8 million in 2019.

What can grant funds be used for?

For bars and restaurants, based on the businesses needs identified in the grant application, funds can be used to support working capital (rent, payroll, and other accounts payable), job training (such as new practices related to take out, delivery and sanitation) and technology enabling new operations as well as other costs to implement that technology. For hotels, funds can be used as working capital to support the retention of employees.

How do businesses apply?

Businesses can submit an application online here: Landing Page, English Application, Spanish Application. Applications for awards will be accepted until 5:00 p.m. on April 1st, and winners will be chosen via a lottery, therefore, there is no benefit to submitting an application first as long as a valid, complete application is received by the deadline.

How much money is available?

$14 million is available under this program.

Bars and restaurants that generated less than $500,000 in annual revenue last year will be eligible for up to $10,000.

Bars and restaurants that generated between $500,000 and $1M in annual revenue last year will be eligible for up to $25,000.

Hotels that generated less than $8 million in annual revenue last year will be eligible for up to $50,000.

How soon will businesses receive funds?

Accion will notify businesses on April 4th if they have received an award. Accion and DCEO are striving to make funds available to awarded businesses within two days of receiving the necessary bank information from an awarded grantee.

Illinois Small Business Emergency Loan Fund

DCEO and the Illinois Department of Financial and Professional Regulation (IDFPR) are establishing the Illinois Small Business Emergency Loan Fund to offer small businesses low-interest loans of up to $50,000.

Businesses located outside of the City of Chicago with fewer than 50 workers and less than $3 million in revenue in 2019 will be eligible to apply. Successful applicants will owe nothing for six months and will then begin making fixed payments at a below-market interest rate for the remainder of a five-year loan term. Starting this Friday, March 27th, interested businesses will be able to express interest at a form that will be posted here.

Who is eligible?

Small businesses located outside of the City of Chicago with fewer than 50 workers and less than $3 million in revenue in 2019 can apply. Small businesses within the City of Chicago can apply to a similar loan program here.

What can loan funds be used for?

Loans can be used to support working capital.

How do businesses apply?

Businesses will be able to complete an interest form on this web page on Friday, March 27, 2020.

How much money is available?

Businesses can receive up a low-interest loan of up to $50,000 with a 5 year repayment period with no payments due for the first six months.

How soon will businesses receive funds?

Eligible businesses will be invited to submit a full application beginning on April 1. Once submitted, we will strive to make a loan decision within 10 days, and make funds available within two days of receiving bank information from a business.

Downstate Small Business Stabilization Program

To support small businesses in downstate and rural counties across Illinois, DCEO is repurposing $20 million in CDBG funds to support the Downstate Small Business Stabilization Program.

This Fund will offer small businesses of up to 50 employees the opportunity to partner with their local governments to obtain grants of up to $25,000 in working capital. These grants will be offered on a rolling basis.

Who is eligible?

Local governments can apply on behalf of businesses with 50

employees or less.

Only units of local government recognized by the Illinois Constitution and able to support economic development activities on a sufficient scale are eligible to apply for Economic Development grant funding. This includes cities, villages, and counties. Municipalities must not be a HUD direct Entitlement community or be located in an urban county that receives “entitlement” funds. Application materials will be posted to the DCEO website on Friday, March 27, 2020 Read more.

The State of Illinois is also working with local financial institutions to provide low-interest loans to businesses and non-profits negatively impacted by the COVID-19 crisis and that would not otherwise qualify for a traditional loan. More information can found below.

- Small Business COVID-19 Relief Program

- List of approved lenders

- Low-interest bridge loans for Illinois business in the works

Constituents with questions about these programs or other information related to the COVID-19 outbreak and its effects can call Rep. Severin’s office at 618-440-5090 or email [email protected].

The US Small Business Administration has a COVID-19 Resources site here. The SBA will work directly with state Governors to provide targeted, low-interest loans to small businesses and non-profits that have been severely impacted by the Coronavirus (COVID-19). The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

The U.S. Small Business Administration has already approved Illinois’ eligibility for disaster assistance loans for small businesses facing financial hardship in all 102 counties due to COVID-19. Eligible businesses can apply for up to $2 million in low-interest loans here.

Business advisors at our Illinois Small Business Development Centers (SBDCs) are available to assist small businesses with the loan application process and are currently operating remotely. Businesses can locate their nearest Small Business Development Center here.

How You Can Help

The best way you can help during the COVID-19 outbreak is to wash your hands often and stay at home. Here are other ways you can help:

Donate Personal Protection Equipment (PPE)

DONATE PERSONAL PROTECTIVE EQUIPMENT (PPE)

During this unprecedented public health emergency, supplies of PPE for healthcare providers are being rapidly depleted. Health care personnel need to protect themselves when caring for patients by adhering to infection control and prevention practices, which includes having access to a sufficient supply of PPE.

On March 17, IDPH provided guidance to hospitals, outpatient surgical and procedural centers to limit non-essential adult elective surgical procedures, including all dental procedures until further notice. IDPH is encouraging all outpatient surgical and procedural centers, ambulatory surgical centers, and veterinarians to donate their unused PPE that is not immediately needed to assist those on the frontlines in the fight against COVID-19. Especially of need are surgical gloves, gowns, goggles, face shields, surgical masks, and N95 respirator masks.

To donate PPE to the State of Illinois’ PPE Donation program, please e-mail [email protected]

Medical Professionals Needed – Governor Calls to Action through “Illinois Helps”

The state of Illinois is calling on physicians, nurses, physicians’ assistants, and respiratory therapists who left the healthcare field to reactivate their professional licenses and join the effort to save lives during the COVID-19 outbreak.

The state is streamlining the process for healthcare professionals who have retired or recently left the profession to reactive their licenses by:

- Waving fees and expediting licensure for healthcare positions

- Automatically extending licenses soon to expire

- Making it easier for out-of-state healthcare professionals to practice here, that way border communities can deploy physicians where they are needed most

Reinstate your license:

- Health Care License Reinstatement

- Physician License Reinstatement

- Out of State Temporary Practice Permit

Additional information can be found at www.IDFPR.com or www.coronavirus.illinois.gov

By registering with Illinois Helps, an Emergency System for Advance Registration of Volunteer Health Professionals (ESAR-VHP), you can be part of an alert system and respond if available, when activated, to a significant disaster or public health emergency. The link to Illinois Helps is: https://www.illinoishelps.net/

What is the Emergency System for Advanced Registration of Volunteer Health Professionals (ESAR-VHP)?

The mission of the ESAR-VHP program is to establish a national interoperable network of state-based volunteer registration systems for managing volunteers at all tiers of response. Each system verifies the identity, credentials, certifications, licenses, and hospital privileges of health professionals who volunteer to provide health services during a public health emergency.

What is Illinois HELPS?

Your ESAR-VHP system is an initiative to pre-register, manage, and mobilize clinical and non-clinical volunteers to help in responding to all types of disasters. The volunteer management system is part of a nation-wide effort to make sure that volunteer professionals can be quickly identified and their credentials checked so that they can be properly utilized in response to a public health emergency or disaster.

General Assembly: Legislative session canceled until at least April 5.

Due to concerns over the potential spread of COVID-19, the Illinois General Assembly has canceled Session days planned until at least April 5. The deadline to pass bills through Committee was extended until April 24 and the deadline to pass bills on Third Reading is extended until May 8.

Local Government Revenue Update (03-25-20) – Sales Tax Distribution

There is no expected delay in the distribution of sales tax revenues due to workforce changes in response to the COVID-19 pandemic. However, the recent sales tax relief provided to eating and drinking establishments will delay collections from those businesses, which translates into a delay in distributions of those sales tax revenues to local governments.

The recent decrease in fuel prices will result in a reduction in sales tax revenues from this commodity, which may negatively impact distributions to local governments.

While sales at grocery stores and pharmacies have increased, it’s important to keep in mind State and local governments derive no little to no tax revenues from food nor medicine.

Housing

The Governor has ordered all state, county and local law enforcement to cease enforcement of orders of eviction during the duration of the Gubernatorial Disaster Proclamation. Individuals are still required by law to pay rent and mortgage payments and to comply with other obligations under tenancy or mortgage.USDA Rural Housing Service UPDATE 03-25-20

Single-Family Housing– Effective March 19, borrowers with USDA single-family housing Direct and Guaranteed loans are subject to a moratorium on foreclosure and eviction for a period of 60 days. This action applies to the initiation of foreclosures and evictions and to the completion of foreclosures and evictions in-process.

Guaranteed Loan Program: Guaranteed Loan borrowers who are in default or facing imminent default due to a documented hardship can have payments reduced or suspended by their lender for a period not to exceed 12 months delinquency. Once the hardship is resolved, the lender can modify the loan to cure the delinquency or make up the missed payments based on the borrower’s individual circumstances. Guaranteed Loan servicing questions should be directed to: [email protected].

Direct Loan Program: USDA has waived or relaxed certain parts of the application process for Single-Family Housing Direct Loans, including site assessments, and has extended the time period that certificates of eligibility are valid. A Direct Loan borrower who is experiencing a reduction of income by more than 10 percent can request a Payment Assistance package to see if he/she is eligible for payment assistance or for more assistance than currently received. Moratorium Assistance is available for Direct Loan borrowers experiencing medical bill expenses (not covered by insurance) or job loss because of COVID-19. Qualifying borrowers can receive a moratorium on house payments for a period of time, repaid at a later date. Direct Loan questions should be directed to USDA’s Customer Service Center at 800-414-1226 (7:00 a.m.-5:00 p.m. Eastern Time Monday-Friday). Call volume and wait times are high at this time.

Multi-Family Housing. Multi-Family Housing is taking several steps to help owners, management agents and tenants maintain quality housing during the COVID-19 outbreak. Specifically, three immediate steps are effective for Section 515 Multi-Family properties:

Tenant certifications due March 31, April 30 and May 31 for Multi-Family properties have been extended to June 30 with no late fees or overage charges, as allowed in Multi-Family guidance (HB-3-3560, Chapter 4, Section 4.11). This extension will allow for additional time to complete needed certifications while avoiding face-to-face meetings as recommended by the Centers for Disease Control and Prevention (CDC).

Late fees on Section 515 mortgages will be waived, subject to waiver authority in 7 CFR 3560.403 (c)(3).

Section 515 Annual Financial Statements due March 31 will be extended 30 days, as per Multi-Family guidance (HB-2-3560 Chapter 4, Section 4.16-H). USDA is exploring whether a longer extension is appropriate and will provide further guidance.

Current policy states that owners must process an interim recertification at the tenant’s request if there is a change in income of $50 or more per month. The owner should already have this policy in writing and apply it consistently. To the maximum extent possible, we encourage all owners to work with all tenants with impacted income to adjust rent payments.

The USDA encourages all owners to work with impacted residents and families to adjust rent payments, enter into forbearance agreements, and lessen the impact on affected residents.

At this time, no additional subsidy funding has been made available. If borrowers are temporarily unable to make loan payments, the Agency may waive late fees and enter into an official workout plan.

Jobs (Now Hiring)

- Job Openings and resources compiled by the Illinois House Republican Caucus.

- Who’s Hiring list from the Illinois Retail Merchants Association. Illinois grocers throughout the state are looking to hire. Simply click on the name of the grocer and submit an application. Many are hiring on-the-spot.

Federal Government Passes Economic Relief Package – Details Below

President Donald J. Trump Signs the Coronavirus Aid, Relief, and Economic Security Act (CARES)

Following extensive negotiations between the Trump Administration and Congressional Leaders, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES). The $2.2 trillion economic relief package provides American families, healthcare workers, and small businesses with the economic support they need to get through this challenging time. The package includes $1,200 payments to qualifying Americans, $100 billion in direct support for hospitals, and over $370 billion to small business owners to keep their employees on the payroll. It also includes direct relief for State, Tribal, and local governments through the $150 billion Coronavirus Relief Fund. Each State will receive at least $1.25 billion. $8 billion is set aside for tribal governments. This aid comes on top of the Family First Coronavirus Aid Package, enacted last week, which increased the federal share of Medicaid payments through the emergency period by 6.2 percentage points and provided reimbursements to States for the cost of expanding certain public assistance programs. State/Local/Tribal provisions include:

· $150 billion in direct aid to State, Tribal, and local governments. Aid will be allocated primarily by a State’s population with each State receiving at least $1.25 billion.

· $340 billion in emergency funding to combat the coronavirus outbreak, with $274 billion going to state and local governments for specific purposes. This is in addition to the $150 billion distributed to states to cover their own separate efforts and forms a major part of the federal government’s plan to assist state efforts.

· $5 billion for the Community Development Block Grant program, including $2 billion to existing CDBG grantees that received funding in FY 2020. The bill also provides $1 billion for states and insular areas to respond to COVID-19, including activities within entitlement and non-entitlement communities and requires that those allocations. Any remaining funds will be distributed directly to states on a rolling basis.

· A $500 billion for loans and guarantees through an Economic Stabilization Fund that authorizes the U.S. Treasury to support eligible businesses and States and local governments to cover losses incurred as a result of COVID-19.

· $100 billion for hospitals and health care facilities to reimburse expenses or lost revenues not otherwise reimbursed that are directly attributable to COVID-19.

· $3.5 billion to allow States to expand childcare benefits for healthcare workers, first responders, and others on the frontlines of this crisis.

· Additional federal funding for joint federal-state programs like Medicaid and unemployment compensation, along with other expenditures which will reduce some of the need for states to undertake new COVID-19 spending on their own.

Illinois Emergency Management Agency Unveils Public Assistance Program

The Program is an opportunity for local governments and non-for-profits to apply for reimbursement on costs associated with emergency protective measures related to COVID-19. To qualify, costs must exceed $3,300.

Public Assistance (PA) Program Process

General

- The Public Assistance (PA) Program may provide federal disaster assistance to states, local units of government and certain private non-profit organizations for debris removal, emergency protective measures and the permanent restoration of public facilities as a result of a declaration of a major disaster or emergency made by the President.

Damage Assessment

- Initial Damage Assessment (IDA)

- After a disaster or emergency incident occurs, potential

applicant organizations are responsible for performing an Initial Damage

Assessment (IDA) to identify damages, costs and impacts of the incident.

Potential applicant organizations include:

- State government organizations, including departments, agencies, boards commissions, authorities and universities

- Local government organizations, including counties, townships, municipalities, school districts and special districts

- Private non-profit organizations that provide services of a governmental nature, including hospitals, utility cooperatives, and parochial schools

- Native American tribes or tribal organizations

- Potential applicant organizations must use IEMA damage

assessment documents or online tool (under development/as available) to compile

and report their damages and costs to IEMA. These IDA documents/tools include

the following:

- Initial Damage Assessment Checklist – This checklist provides information on the costs eligible under each category of work. All costs must be reported by county and category of work.

- Initial Damage Assessment Cost Tabulation Form – This document must be used to compile and report damages and costs to IEMA. Once this form is completed, it should be forwarded to IEMA and the appropriate county emergency management agency/ESDA and IEMA regional office.

- Potential applicant organization must complete an IEMA Disaster Impact Assessment (DIA) form to provide information on the impacts (e.g. shelters opened, businesses closed, schools closed) for the incident. Organizations within a county should submit their DIA form to the county ESDA/EMA. They will then compile and submit one DIA form to IEMA to identify the impacts for the entire county.

- After a disaster or emergency incident occurs, potential

applicant organizations are responsible for performing an Initial Damage

Assessment (IDA) to identify damages, costs and impacts of the incident.

Potential applicant organizations include:

- Preliminary Damage Assessment (PDA)

- The PDA is the formal process where teams collect information on the damages, costs and impacts for an incident.

- The PDA is conducted by teams, which include Federal, State and local government representatives.

- Each potential applicant organization is responsible for identifying and showing damages and costs to the PDA team.

- The PDA is typically used as a basis for the Governor to request a major disaster or emergency declaration.

- It is very important that all affected organizations participate in the PDA to capture all of the potential damages and costs for the state.

- All costs reported during the PDA must be supported by documentation (e.g. location maps, photos, estimates, bills, invoices, receipts, equipment and labor records, contract documents).

Declaration Types

- Major Disaster Declaration

- When a catastrophe occurs in a State, the Governor may request a major disaster declaration

- The basis of the request shall be a finding that:

- The incident is of such severity and magnitude that effective response is beyond the capability of state and affected local governments;

- Federal assistance under the Stafford Act is necessary to supplement the efforts and available resources of the state and local governments, disaster relief organizations, and compensation by insurance for disaster-related losses.

- Factors considered when evaluating a Governor’s request for

a major disaster declaration:

- Estimated cost of the assistance

- FEMA evaluates the estimated cost of the federal and non-federal assistance against the statewide population to give some measure of the per capita impact within the state.

- FEMA uses a statewide per capita impact indicator of $1.53 per person (FFY2020) as an indicator that the disaster incident is of such size that it might warrant federal assistance.

- Insurance coverage in force

- FEMA considers the amount of insurance coverage in force or should have been in force as required by law and regulation at the time of the disaster.

- Hazard mitigation

- FEMA considers the extent to which state and local government measures contributed to the reduction of disaster damages for the disaster under consideration.

- Recent multiple disasters

- FEMA considers the recent disaster history within the last twelve-month period to better evaluate the overall impact on the state or locality.

- Programs of other federal assistance.

- FEMA considers programs of other federal agencies, because at times, their programs of assistance might more appropriately meet the needs created by the disaster.

- Estimated cost of the assistance

- Once a declaration is made by the President, FEMA uses a county per capita impact indicator of $3.84 per person (FFY2020) as one of the criteria to designate counties for Public Assistance Program funding under the declaration.

- The statewide and county per capita impact indicators are adjusted annually based on the Consumer Index for all Urban Consumers

- Emergency Declaration

- When an incident occurs or threatens to occur in a state, which would not qualify under the definition of a major disaster, the Governor may request that the President declare an emergency.

- The basis for the Governor’s request must be the finding that

the situation:

- Is of such severity and magnitude that effective response is beyond the capability of state and affected local governments;

- Requires supplementary federal assistance to save lives and protect property, public health and safety, or to lessen or avert the threat of a disaster.

Post-Declaration

- Applicant’s Briefings

- Applicant’s Briefings are held in the affected areas as soon as possible after the declaration is made.

- Applicant’s Briefings provide information on program requirements, funding process and completing application documents.

- All potential applicant organizations are encouraged to attend the Applicant’s Briefing for their area.

- Application

- Applicant organizations must submit a FEMA Form 009-0-49, Request For Public Assistance (RPA) using the PA Grants Portal to IEMA within 30 days of the declaration date or date their county was designated for Public Assistance to be eligible for assistance. Applicants should contact the IEMA PA staff at (217) 782-8719 or [email protected] to request an invitation to register in the PA Grants Portal.

- Applicant organizations must also complete and submit a IEMA Form PA101, Public Assistance Grant Agreement to IEMA. The PA Grant Agreement must be completed and signed by the chief elected official of the organization. Only the originally signed PA Grant Agreement will be accepted. Faxes or photocopies of the PA Grant Agreement are not acceptable.

- Applicant organizations must complete and submit a IEMA Form PA108, Public Assistance Risk Assessment to IEMA. IEMA will use this assessment to determine the appropriate level of monitoring for the organization during the performance of the grant.

- Applicant organizations must complete and submit the IEMA Form PA109, FFATA Certification to IEMA. The FFATA Certification must be completed to provide information on the organization’s FFATA status regarding reporting.

- Exploratory Call

- FEMA will assign a Program Delivery Manager (PDMG) as a single point of contact for each applicant, to provide assistance through the PW development process.

- The PDMG will conduct an Exploratory Call with assigned applicant representatives to obtain general information about the applicant and its disaster impacts, and to explain next steps.

- Applicant representatives should be prepared to discuss damages, costs and impacts for their organizations.

- Applicant representatives will also learn more about the PA Grants Portal, which is the online data base used to manage grant applications and upload required documents to FEMA.

- Recovery Scoping Meeting (formerly Kickoff Meeting)

- The PDMG will contact each applicant within 21 days of the Exploratory Call to conduct a Recovery Scoping Meeting.

- During the meeting, the PDMG and applicant will have an in depth discussion on damages and costs, develop a list of projects and compile any documentation the applicant may have at that time.

- The PDMG will coordinate the scheduling of any site inspections necessary to complete PWs.

- Applicants have 60 days after the Recovery Scoping Meeting to identify and report damages to FEMA, in accordance with 44 CFR, 206.203(d)(ii).

- After the meeting, the applicant and the PDMG should agree to weekly status meetings, until all PW work has been completed.

Project Worksheets (PWs)

Subgrant Closeout

- All subgrants must be closed.

- Once all work has been completed, bills are paid, and the Federal share has been reimbursed, the applicant organization should complete and submit a IEMA Form PA107, Subgrant Closeout Certification form to IEMA to close their subgrant.

- Applicants may request subrecipient management cost funding at subgrant closeout by completing and submitting an IEMA Form PA110, Subgrantee Management Cost Request to IEMA, along with actual cost documentation to support the costs being claimed.

- IEMA will review the closeout documents submitted, perform any final inspections, process any necessary payment, and send a letter to the applicant closing the subgrant.

Grant Closeout

- Once all subgrants have been closed, IEMA will work with FEMA to reconcile all grant expenditures and close the PA grant.

Stay Connected!

Throughout the rest of this crisis, my office will only be offering remote constituent service. You can contact my office staff by calling 618-440-5090 or email me at [email protected]. Please stay safe and heed the warnings from elected officials.