SPRINGFIELD, IL – State Representative Dave Severin (R-Benton) says he will strongly oppose any attempt by Illinois Democrats to raise billions in new taxes as the House’s May 31st adjournment date draws closer.

“Since Governor Pritzker took office, baseline state budget spending has increased by nearly $15 billion. That’s an enormous increase in just six years, and Illinoisans cannot afford to continue to pay more taxes to fund a government that is growing out of control,” Severin said. “We need to prioritize the citizens of Illinois, not the illegal immigrants who have collected $3 billion in welfare and medical services during the last three years under our state’s disastrous Sanctuary State policies.”

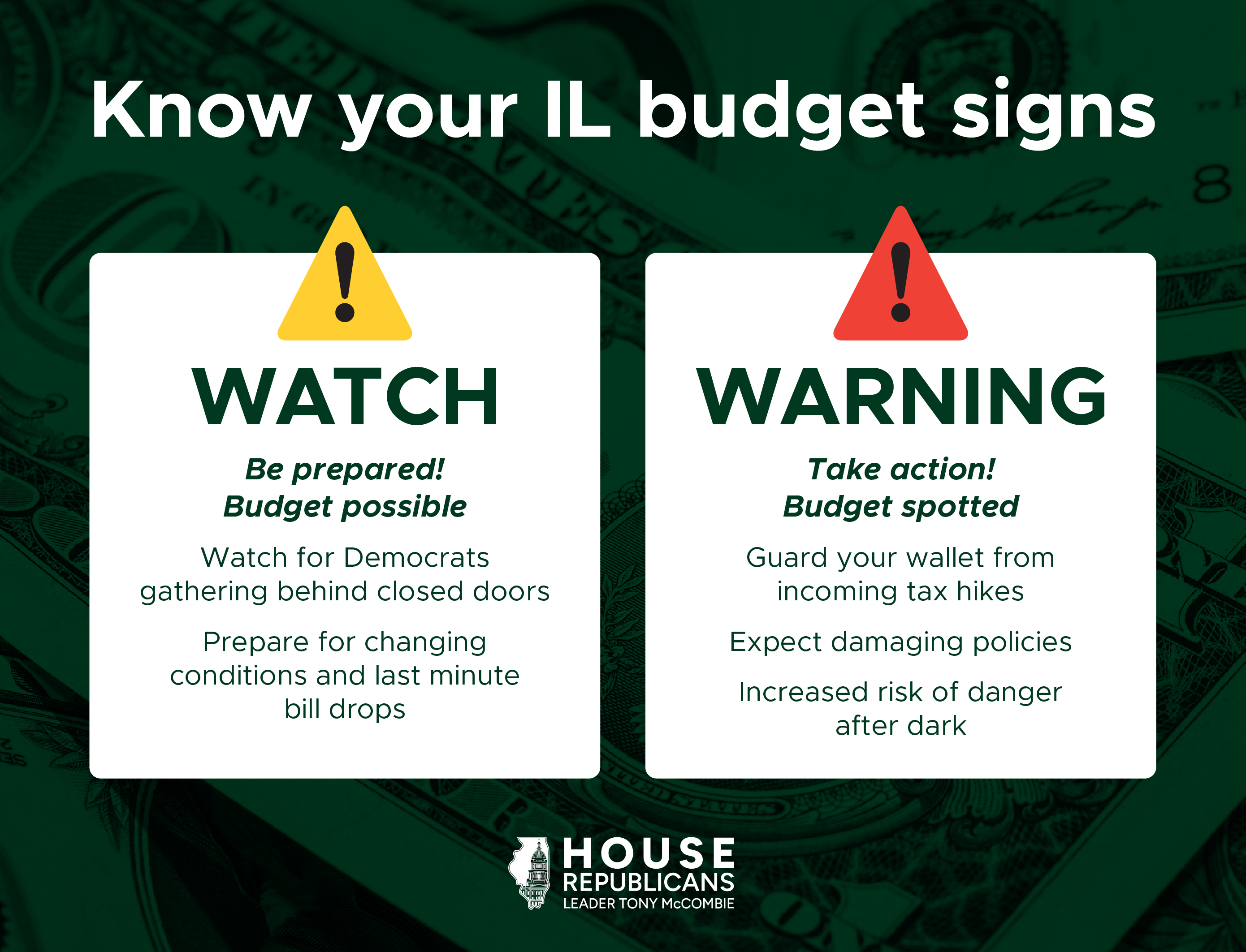

Proposals from advocacy groups and elected Democrats for billions of dollars of tax hikes through expanded sales taxes on services, delivery, advertising, and more have been floated in recent days and weeks as ways to balance the state’s ballooning budget. Severin says Illinoisans are tapped out, and the time for belt-tightening is now.

“Democrats and their allies have introduced a shocking total of more than $10 billion in proposed tax hikes on everything from haircuts to business tax incentives. We already rank at or near the bottom of every list of taxpayer-friendly and business-friendly states,” Severin said. “Taxpayers should not be on the hook to clean up the mess made by irresponsible Democrats, who have overspent and overregulated to the point that people are fleeing the state. More taxes will mean more people leaving. As we stare at a budget deficit, and as Democrats once again go to the taxpayers to bail them out, I will stand against any tax increases or attempts to grow government further.”

Various advocacy groups, including the Chicago Teachers Union and the Illinois Revenue Association, have brought forward tax hike proposals in the following amounts for the following categories.

Sales Tax on Services – $2.7 billion

Delivery and Digital Advertising Taxes – $890 million

Investment and Wealth Taxes – $4.24 billion

Gambling and Casino Taxes – $1.89 billion

Business and Corporate Taxes – $2.3 billion

###